The federal government plays an important role in creating the right economic conditions that lead to job creation. However, not all jobs are created equal and many Canadians work in precarious and insecure jobs. Precarious jobs are characterized by a lack of stability and predictability and usually do not pay well enough to allow workers to afford basic necessities like adequate housing, transportation and sufficient food.1 A health-enhancing jobs plan is one that creates and maintains good jobs that enable Canadians to meet their day-to-day needs and plan for a secure future.

Canada has a myriad of federal programs that provide income support to different populations: Employment Insurance (EI) primarily for the unemployed; Canada Pension Plan (CPP), Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) for seniors; and the Working Income Tax Benefit (WITB) for people with low employment earnings. The level of income support that each program provides varies widely and some populations are more likely than other Canadians to experience high levels of poverty.

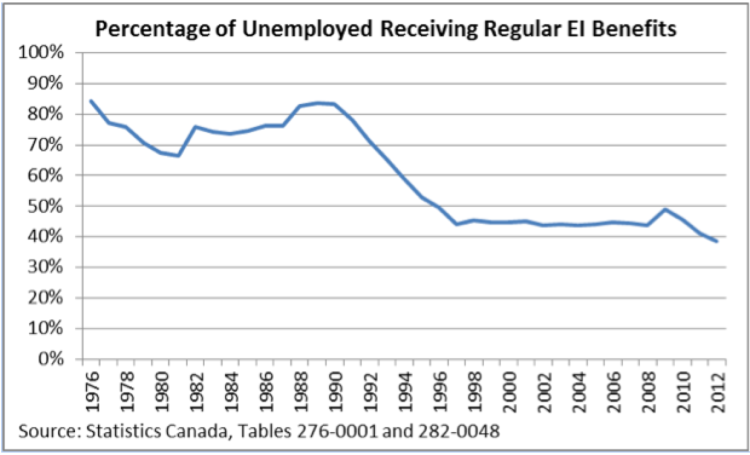

In recent years the ability of Canada’s income support programs to provide adequate coverage has been eroding, with EI coverage arising as a particular concern. The percentage of unemployed workers receiving regular EI benefits has been dropping, due both to changes in the patterns of labour market participation, as well as policy changes that have made it more difficult for unemployed workers to access EI.

A plan to create good jobs, improve the quality of existing jobs, and enhance income security would improve the health of Canadians.

Health Impacts of Jobs and Income

Stable, secure, and adequate jobs promote good health by providing benefits, time to recover from illness, reasonable working hours, and other health-enhancing features.3

Over 930,000 Canadian multiple jobholders in 20145

Over 2,000,000 Canadian temporary workers in 2014

$16.18: the median hourly wage of temporary employees in 2014

$22.03: the median hourly wage of permanent employees in 2014

$5.80: the median hourly temporary wage gap in 20146

Low income is associated with increased risk of cardiovascular disease7 and poor mental health, including increased rates of anxiety, depression, psychological distress and suicide.8MANSEAU, M. W. 2014. Economic Inequality and Poverty as Social Determinants of Mental Health. Psychiatric Annals, 44. ] People with low income are at greater risk of developing diabetes and may face barriers to accessing individual-level interventions like healthy eating and regular physical exercise that can reduce diabetes risk.9

In addition to experiencing poorer health across a range of income-sensitive conditions, living with low income can also contribute to greater risks of mortality. A study of age-standardized mortality rates found that Canadian men in the lowest income quintile were significantly more likely than men in the highest income quintile to die from 28 of the 29 causes of death studied, while women in the same study were more likely to die from 27 of the 29 causes.10 There is, however, a reduction in mortality at each step up the income ladder for most conditions for both men and women, suggesting that even modest increases in income can reduce mortality risks.

Health Equity Impacts of Jobs and Income

Not all Canadians have equitable access to good jobs and adequate income. Young people have been particularly affected by the shift in Canada’s labour market in recent decades away from full-time employment toward increasingly precarious work.11 Canada’s youth unemployment rate in August 2015 was 13.1 percent, almost double the overall rate of 7 percent.12 Being unemployed early in life can contribute to increased risks of cigarette smoking and poor mental health later in life.13

Raclialized Canadians are more likely than many other Canadians to have low income. Racialized Canadians are more likely to be unemployed and earn less on average than non-racialized Canadians. There is also a significant gender divide with racialized women earning only 48.7 cents for every dollar earned by non-racialized Canadian men.14 Racial inequities in jobs and income may have long-term population health impacts given that racialized populations are expected to continue to make up a larger proportion of the Canadian population in coming decades.

Part-time workers have lower average hourly wages than full-time workers.15 Women are disproportionately over-represented in part-time and temporary jobs that do not provide adequate income to support good health. The impacts of low earnings and income is particularly felt by women who lead single parent households. Women sometimes prioritize their children’s needs over their own – for example, by skipping meals so that their children have enough to eat – which can contribute to poor health.16 Children who grow up in low income households may be at greater risk of poor health both in childhood and throughout their life.17

How do the federal parties measure up for equity in jobs and income?

Conservative |

Green |

Liberal |

NDP |

|

|---|---|---|---|---|

| Creating and maintaining good jobs | Aim to create 1.3 million net new jobs by 2020. Job quality not yet addressed. | Create a minimum wage for federally regulated industries, set at $15 per hour. | Not yet addressed |

Crack down on unpaid internships. Create a minimum wage for federally regulated industries, set at $15 per hour. |

| Employment Insurance (EI) |

Use EI account surpluses to reduce premiums paid by employers and employees.

Limit EI eligibility for seasonal or frequent users of EI. |

Significant expansion of EI eligibility and a comprehensive overhaul of the EI system.

|

Use a portion of EI account surpluses to reduce premiums paid by employers and employees.

Use a portion of the EI surpluses to increase funding for training programs and more flexible special EI benefits.

|

Keep EI premiums at $1.88 per $100 earned. Use retained revenue to:

Protect the EI surplus fund from being used as federal government general revenue. |

| Canadian Pension Plan (CPP) |

Explore a modest and voluntary CPP expansion.

|

Expand CPP, phasing in over 5 to 7 years:

|

Expand CPP and support provincial pension plan expansions.

|

Expand CPP, convening meetings with premiers to form plan and timetable within six months of taking office. |

|

Old Age Security (OAS) and the Guaranteed Income Supplement (GIS) |

Increase the age at which seniors are eligible to receive OAS/ GIS payments.

. |

Guaranteed Liveable Income (GLI) program:

|

Keep the age of eligibility for OAS/ GIS at 65.

|

Keep the age of eligibility for OAS/ GIS at 65.

|

|

Income Splitting |

Income splitting:

. |

Eliminate income splitting. |

Keep income splitting for seniors only. |

Keep income splitting for seniors only. |

|

Working Income Tax Benefit (WITB) |

Not yet addressed |

Not yet addressed |

Not yet addressed |

Not yet addressed |

|

Skills training |

Expand the Apprentice Job Creation Tax Credit, and continue to improve federal support for skills-training. |

Retrain forestry workers who lose jobs to industry restructuring. |

$500 million annual increase in funding to the Labour Market Development Agreements with provinces. A $200 million annual increase in funding to be delivered by the provinces and territories and focused on training for workers who are not currently eligible for federal training investment. Renew and expand funding by $50 million to the Aboriginal Skills and Employment Training Strategy (ASETS). |

Not yet addressed |

|

Youth employment |

Not yet addressed . |

Establish a Canadian Sustainable Generations Fund that would:

|

Increase the number of jobs funded by the Canada Summer Jobs program by 35,000 each year. Open space for 11,000 young Canadians to access Skills Link each year. Create 5,000 youth green jobs by hiring more guides, interpreters, and other staff at Parks Canada. Invest $40 million annually to create more co-op placements for students in science, technology, engineering, mathematics, and business programs to help employers create new placement opportunities for students. The program will pay 25 percent of a co-op placement salary, up to a maximum of $5,000, to an employer that creates a new co-operative placement. Work with provinces, territories, and post-secondary institutions to develop or expand Pre-Apprenticeship Training Programs. The program will provide up to $10 million per year. Waive employers’ Employment Insurance premiums for a 12-month period on any net new hire of a full-time employee, aged 18 to 24, in 2016, 2017, or 2018. |

Partner with small business, industry, NGOs and government to help 40,000 young Canadians get jobs, paid internship or co-op placements. Create apprenticeship spaces through federal infrastructure projects, in federally regulated airports or Port Authorities, and with crown corporations. Partner with municipalities and Indigenous governments to hire apprentices for infrastructure projects. |

Health Equity Assessment of Good Jobs Commitments

While it is often said that the best anti-poverty initiative is a job, the need for good jobs to raise Canadians out of poverty and to support health and health equity is often overlooked. While all parties have made commitments about job creation surprisingly little attention has been paid to job quality.

GOOD JOBS

Despite the fact that precarious employment is a growing trend in Canada, only the NDP and Green Party have platform commitments that address job quality with both parties promising to establish a minimum wage of $15 for federally regulated industries (such as banking, shipping, air transportation, railways and telecommunication services). The NDP would also “crack down” on unpaid internships although no further details have been released. Increasing wages of low paid workers in federally regulated industries may contribute to improvements in their health and well-being. There are, however, relatively few Canadians working in federally regulated industries who earn less than $15 per hour18 so the overall effectiveness of this commitment to raise incomes and improve health is likely limited. More effective would be working with provinces to harmonize their minimum wages with the federal standard. The Conservative and Liberal parties have not yet specified how they would improve job quality.

SKILLS DEVELOPMENT

The Liberal Party has committed to increases in funding for Labour Market Development Agreements and the Canada Job Grant, which support provinces and territories to deliver skills and employment programs primarily for people who are unemployed, by $500 million and $200 million, respectively, annually. The effectiveness of these investments to improve health depends on their ability to provide Canadians with training that will enable them to secure well paid, good jobs. The Conservative Party would expand tax incentives for employers that hire apprentices, but no commitments have been made to expanding skills training programs. The Green Party has only committed to skills training for forestry workers who lose their jobs due to industry restructuring. The NDP has not yet addressed skills training.

YOUTH UNEMPLOYMENT

The Liberal Party plan to address youth unemployment relies heavily on increasing the number of federal job placement schemes and offering wage subsidies and payroll tax reductions to employers who hire young Canadians. The NDP would partner with employers to create new paid internships or co-op placements and the NDP and Green Parties would work with municipalities to provide jobs for youth in local infrastructure projects. The Liberal Party, Green Party and NDP initiatives may improve youth employment prospects by providing more opportunities to gain valuable job experience. The Green Party’s Canadian Sustainable Generations Fund would be a major departure from the current model of post-secondary education in Canada, with a goal to eliminate tuition for domestic students by 2020. The Conservative Party has not yet addressed youth unemployment.

Health Equity Assessment of Income Security Program Commitments

Federal income security programs such as EI, CPP, OAS, GIS, and WITB protect Canadians by supporting their incomes when they are unable to gain sufficient income from employment.

EMPLOYMENT INSURANCE

There are significant differences between the federal parties on the best way to move forward with EI. The Green Party and NDP plan to use EI surpluses to expand and enhance EI, while the Conservative Party plan would reduce the premiums that employers and employees pay, and the Liberal Party plan on doing a degree of both. The Conservative Party plan to reduce premiums by around 20 percent which will diminish the ability of EI to be expanded to cover more unemployed workers. The Conservative Party plan does not address the 60 percent of unemployed workers currently not covered by EI. The Liberal Party plan involves reducing premiums by around 12 percent and retaining the other eight percent to fund expansion and enhancement. The Liberal Party has committed to using this portion of EI premiums to halve the waiting period before benefits start, increase parental leave flexibility, increase training programs and expand eligibility. The NDP would keep EI premiums at their current level and use these funds to expand special benefits such as parental leave and expand the eligibility to make EI accessible to more unemployed workers. While reducing premiums will not benefit unemployed workers, expanding coverage and enhancing benefits will, likely leading to improved income and health during spells of unemployment.

CANADA PENSION PLAN

Sufficient income in retirement is necessary for supporting the health of seniors. The Green Party, Liberal Party, and NDP all plan on expanding the Canadian Pension Plan (CPP), while the Conservative Party opposes mandatory CPP expansions, new provincial pension plans and CPP contribution increases. The Conservatives would explore voluntary CPP expansion, though this would not guarantee a pension increase for all Canadian workers. The Green Party’s CPP expansion plan doubles the pensionable income limit to $106,000 and increases benefits from 25 percent to 40 percent of previous earnings. This would substantially increase the amount that Canadian workers would contribute to and receive from CPP. The Liberal Party plan would increase the pensionable income limit from $53,000 to $80,000 and increase CPP benefits to 50 percent of previous earnings, which also constitutes a significant expansion of CPP. The NDP plans on expanding the CPP following consultations with premiers to form a timeline and plan for the expansion. Increasing the pensionable earnings limit and benefit rate may enhance income security of pensioners by increasing their income replacement rate, although these changes would not reduce income inequality among seniors. While raising the pension floor by expanding CPP would help protect pensioners as a group, expanding GIS and other targeted programs could do more to decrease inequality.

OLD AGE SECURITY AND GUARANTEED INCOME SUPPLEMENT

Other income security programs for Canadian seniors include OAS and GIS. The Conservative Party plans on increasing the age at which seniors are eligible for these programs from 65 to 67. GIS is designed to aid low-income seniors, and by delaying the age of eligibility low-income seniors would be at a disadvantage by either having to live with less income or keep working longer. The Green Party, Liberal Party, and NDP have committed to reversing this change and keeping the age of retirement at 65. The Green Party proposes collapsing OAS and GIS into a Guaranteed Livable Income (GLI) program. A Guaranteed Livable Income program that is set at a rate that is sufficient to afford the necessities of life could improve health and health equity for many Canadians.

INCOME SPLITTING

Income splitting is a taxation policy favoured by the Conservative Party that allows couples with children aged under 18 and senior couples to split up to $50,000 of taxable income, lowering taxes on these families up to a maximum of $2,000 through a non-refundable benefit. Income splitting disproportionately benefits higher income families and particular household structures: one earner couples and two earner couples in which there is a significant disparity in income between the earners. If the two earners make similar amounts of money then then income splitting would not reduce their taxes. It also does not benefit single mother led families – 40 percent of whom experience poverty – single member households or couples without children. As a non-refundable benefit, income splitting also only benefits families who owe net taxes at the end of the year, which excludes many low-income families. With the high fiscal cost of this tax reduction method, equity could be better improved with either more progressive tax reductions or more equitable government spending. The Green Party is committed to eliminating income splitting altogether, while the Liberal Party and NDP support keeping it only for seniors.

WORKING INCOME TAX BENEFIT

While the Working Income Tax Benefit (WITB) is an important source of income for the working poor, none of the federal parties have made commitments to enhance, expand, or change the credit. As a theoretically efficient tax benefit that incentivises low-income individuals to enter employment, raising the WITB phase-out threshold and increasing benefit rates could be beneficial for low-income earners, their health, health equity, and the wider economy.

- Employment precarity has 10 indicators including being paid of a day’s work is missed, week-to-week income variation, likelihood of hours of work being reduced and receipt of employment benefits. LEWCHUK, W., LAFLÈCHE, M., PROCYK, S., COOK, C., DYSON, D., GOLDRING, L., LIOR, S., MEISNER, A., SHIELDS, J., TAMBURENO, A. & VIDUCIS, P. 2015. The Precarity Penalty: The impact of employment precarity on individuals, households and communities – and what to do about it. PEPSO, McMaster University and United Way Toronto. ↩

- Annual numbers of unemployed and EI beneficiaries taken as the annual average across calendar months. ↩

- LEWCHUK, W., LAFLÈCHE, M., PROCYK, S., COOK, C., DYSON, D., GOLDRING, L., LIOR, S., MEISNER, A., SHIELDS, J., TAMBURENO, A. & VIDUCIS, P. 2015. The Precarity Penalty: The impact of employment precarity on individuals, households and communities – and what to do about it. PEPSO, McMaster University and United Way Toronto. ↩

- STATISTICS CANADA Table 282-0014 – Labour force survey estimates (LFS), part-time employment by reason for part-time work, sex and age group, annual (persons). ↩

- STATISTICS CANADA Table 282-0031 – Labour force survey estimates (LFS), multiple jobholders by North American Industry Classification System (NAICS), sex and age group, annual (persons). ↩

- Annualized averages from STATISTICS CANADA 2015b. Table 282-0073 – Labour force survey estimates (LFS), wages of employees by job permanence, union coverage, sex and age group, unadjusted for seasonality, monthly (current dollars unless otherwise noted). ↩

- WALTON-MOSS, B., SAMUEL, L., NGUYEN, T. H., COMMODORE-MENSAH, Y., HAYAT, M. J. & SZANTON, S. L. 2014. Community-Based Cardiovascular Health Interventions in Vulnerable Populations: A Systematic Review. Journal of Cardiovascular Nursing 29. ↩

- ↩

- ILKINGTON, F. B., DAISKI, I., BRYANT, T., DINCA-PANAITESCU, M., DINCA-PANAITESCU, S. & RAPHAEL, D. 2010. The Experience of Living with Diabetes for Low-Income Canadians. Canadian Journal of Diabetes, 34. ↩

- TJEPKEMA, M., WILKINS, R. & LONG, A. July 2013. Cause-specific mortality by income adequacy in Canada: A 16-year follow-up study. Health Reports, 24, 14-22. ↩

- LAW COMMISSION OF ONTARIO 2012. Vulnerable Workers and Precarious Work ↩

- STATISTICS CANADA September 2015. Labour force survey, August 2015. ↩

- HAMMARSTRÖM, A. & JANLERT, U. 2002. Early unemployment can contribute to adult health problems: results from a longitudinal study of school leavers. Journal of Epidemiology and Community Health, 56, 624-630. ↩

- BLOCK, S. & GALABUZI, G.-E. 2011. Canada’s Colour Coded Labour Market: The Gap for Racialized Workers. Wellesley Institute and Canadian Centre for Policy Alternatives. ↩

- STATISTICS CANADA 2015a. Average hourly wages of employees by selected characteristics and occupation, unadjusted data, by province (monthly) (Canada). ↩

- ATTREE, P. 2005. Low-income mothers, nutrition and health: a systematic review of qualitative evidence. Matern Child Nutr, 1, 227-40.; PAUL SEN GUPTA, R., MAMATIS, D., WADE, K. & FORDHAM, J. December 2011. Perspectives of Parenting on a Low Income in Toronto. Toronto Public Health. ↩

- SPENCER, N., THANH, T. M. & LOUISE, S. 2013. ‘Low Income/Socio-Economic Status in Early Childhood and Physical Health in Later Childhood/Adolescence: A Systematic Review. Maternal Child Health Journal, 17. ↩

- MINSKY, A. August 6, 2015. Reality check: Does the NDP minimum wage plan leave out 99% of minimum wage earners? Global News. ↩