According to the latest census data several changes have taken place in Toronto’s housing market which have had consequences for population health. More people are renting their homes than ever before, women and older adults continue to live in unhealthy rental housing, and fewer homes are available at rents affordable to low-income households. Additionally, many people are struggling with housing costs as expensive rentals have priced people out of the market. These trends are concerning, as everyone needs affordable, safe, and suitable housing in order to lead a healthy life.

Collected during the second year of the COVID-19 pandemic, the 2021 Census data reflects the housing challenges many renter households face, and will continue to face if trends persist.

More people are renting

Rental housing has seen rapid growth. Of the 127,000 net new households in the GTA since 2016 58% were renters, which increased the percentage of households renting to 35%. In the decades prior, homeownership rates were growing but since 2011 renting has increased and homeownership has subsequently declined.

People aged 30 to 45 saw the greatest shift from owning to renting. Over the 10 years from 2011 to 2021, the percentage of 30 to 45-year-olds owning a home dropped by 9%. This change relates to the rising cost of homeownership; more people are waiting longer to buy a home or are unable to own a home at all.

As more people rely on the rental market to provide safe and suitable homes governments must ensure a supply of affordable rental options that are adequate to ensure all renters can afford a healthy home.

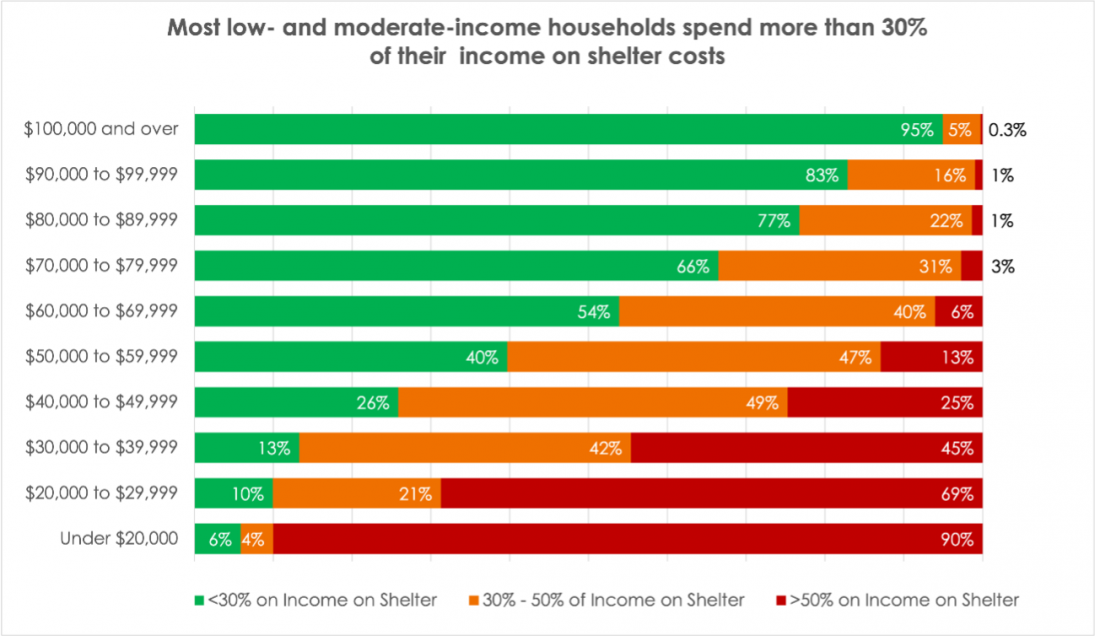

Many low and moderate-income renters spend large portions of their income on shelter

In 2021, 290,000 GTA renter households had shelter costs that were unaffordable (representing 30% to 50% of household income) or severely unaffordable (representing more than 50% of household income). Three-quarters of renter households that earned less than $60,000 per year spent more than 30% of their income on shelter costs – the commonly accepted benchmark for housing affordability. The people most impacted by severely unaffordable rents were those earning minimum wage or less, older adults on fixed incomes, ODSP (Ontario Disability Support Program) and OW (Ontario Works) clients, and students.

In addition to a greater rental supply that to renters who make less than $60,000 per year can afford, more housing subsidies are needed to ensure that all households have access to affordable and safe housing.

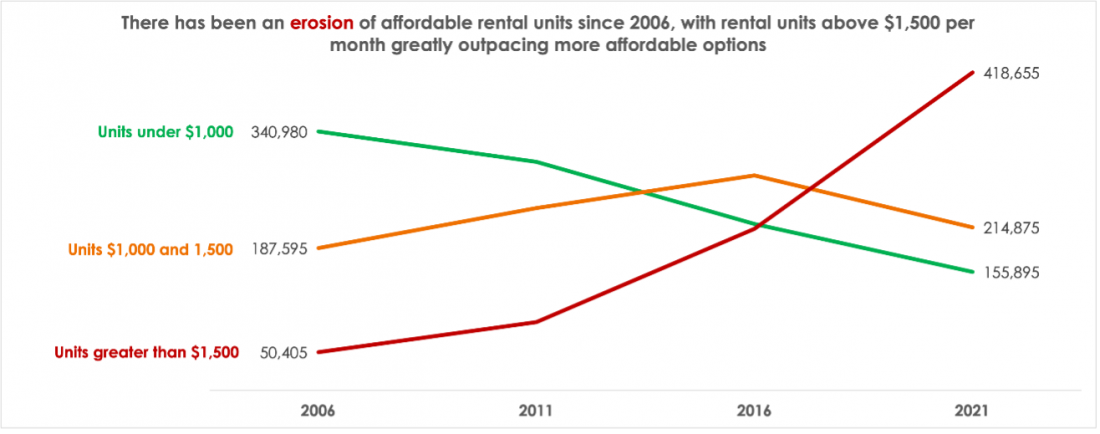

Toronto lost more than 130,000 rental units available at under $1,500 per month

In the past 5 years alone, the GTA lost 27% of its private rental apartments that were affordable to households earning less than $60,000 a year.

While apartments under $1,000 dominated the rental market in 2006 their share fell to 20% in 2021. Meanwhile, apartments renting for more than $1,500 per month have skyrocketed. The number of higher cost rentals grew from 50,000 units in 2006 to 419,000 units in 2021. They now represent more than half of the market rental homes available in the Toronto region.

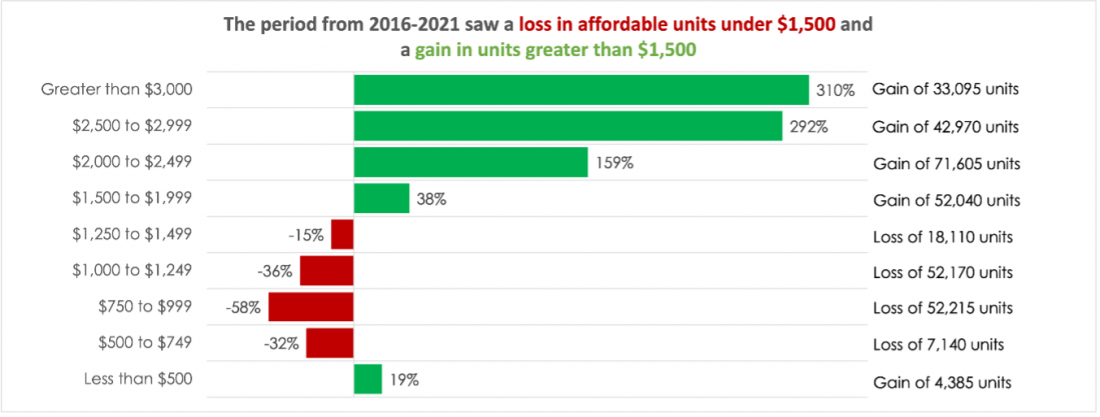

With the erosion of affordable rental options most renters are now paying over $1,500 per month for shelter. From 2016-2021, Toronto gained over 76,000 units that rent for $2,500 or more per month. This change is driven by two factors. First, existing apartments have become more expensive over time. In fact, average rents in the GTA have increased 50% faster than median renter household incomes between 2006 and 2021. Second, there has also been a rapid growth in higher-cost rental units being built, including rented condos.

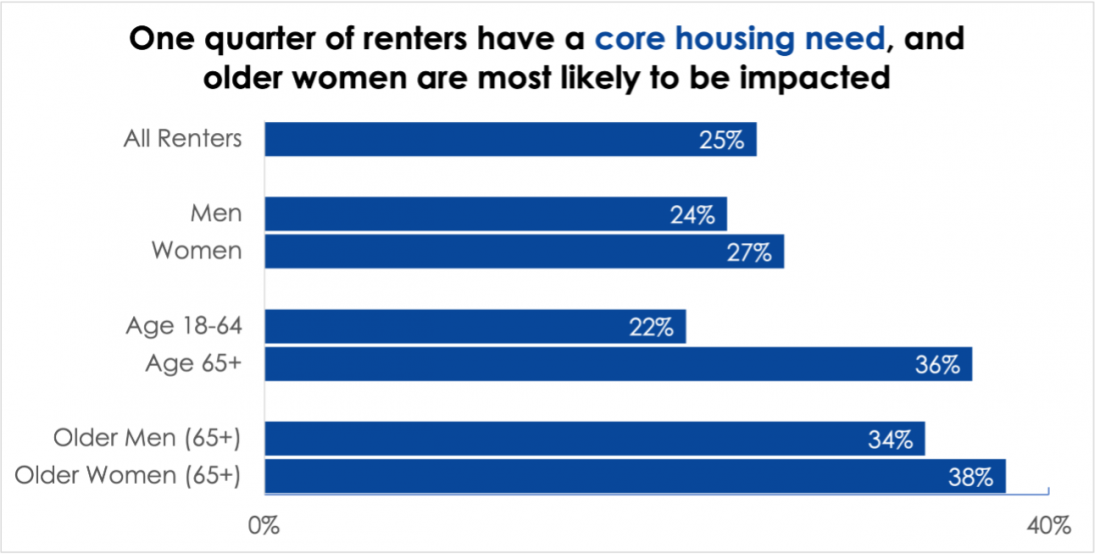

Over 200,000 Toronto renters had a core housing need

“Core housing need” refers to households that fall below certain housing standards. A household is in core housing need when their residence needs major repairs, is not large enough, or is unaffordable. While the proportion of renters in core housing need decreased from 36% in 2016 to 25% in 2021, the total number of renters with core housing need has remained relatively stable with a net decrease of only 23,000 households.

The success of temporary pandemic-era income security programs likely contributed to the reported decrease. This Census relies on income data from 2020, when programs such as the CERB were rolled out, meaning gains may be temporary.

More women experienced inadequate housing than men. 41,750 women over the age of 65 had a core housing need. Among older adults with a core housing need, approximately half (37,870) lived alone with a median income of $23,600 per year.

Where do we go from here?

Loss of affordable housing combined with an increase in expensive rental units indicates an emergency for low and moderate-income households. The data also reveals that even renters who make under $60,000 a year face challenges as rents continue to skyrocket and the cost-of-living increases. How do we ensure that people have access to affordable, high-quality housing so that they can Thrive in the GTA?

Policy makers must prioritize the creation and preservation of affordable rental housing targeting low and moderate-income households. They should also target rental buildings that are at risk of losing their affordability with programs to bring these units into permanent affordability through non-profit control. Financial supports for lower-income residents should also be on the agenda.

All levels of government need to immediately set clear targets for building and maintaining affordable housing, with the goal of ensuring all households, regardless of income, have a healthy home they can afford. Only then will we set the groundwork for a more equitable GTA.